CONTENTS

When it comes to online shopping, how we pay matters just as much as what we buy.

Let’s take a closer look at the top 10 payment methods for online shoppers in 2024 and what they reveal about the evolving landscape of e-commerce.

Current and Future Payment Options for Online Shoppers

- Digital Wallets

- Transaction Value (2023): $3.1 trillion

- Transaction Value (2027): $5.4 trillion

- Share of E-commerce Transactions (2023): 50.0%

- Share of E-commerce Transactions (2027): 61.0%

Digital wallets are on a winning streak, with their transaction values skyrocketing by 74% from 2023 to 2027. It’s clear that consumers are increasingly drawn to the convenience and security of digital payments, making them a top choice for online shopping payment methods.

- Credit Cards

- Transaction Value (2023): $1.364 trillion

- Transaction Value (2027): $1.328 trillion

- Share of E-commerce Transactions (2023): 22.0%

- Share of E-commerce Transactions (2027): 15.0%

While credit cards are still widely used, their share of e-commerce transactions is expected to dip. This could signal a shift towards alternative payment methods or tighter regulations on credit practices, highlighting the importance of exploring e-commerce alternative payment methods.

- Debit Cards

- Transaction Value (2023): $744 billion

- Transaction Value (2027): $756 billion

- Share of E-commerce Transactions (2023): 12.0%

- Share of E-commerce Transactions (2027): 8.0%

Debit cards remain popular, but their share of e-commerce transactions is projected to decrease slightly. This suggests that consumers are diversifying their payment preferences, seeking out e-commerce payment options that best suit their needs.

- A2A (Account-to-Account)

- Transaction Value (2023): $449 billion

- Transaction Value (2027): $756 billion

- Share of E-commerce Transactions (2023): 7.0%

- Share of E-commerce Transactions (2027): 8.0%

A2A payments are gaining traction, nearly doubling in transaction value by 2027. This reflects a growing preference for direct bank transfers, which are simple and cost-effective e-commerce payment methods.

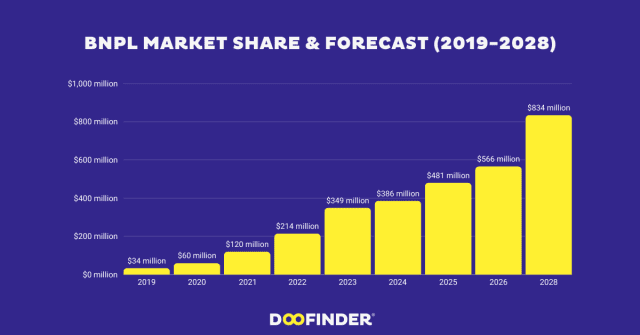

- BNPL (Buy Now, Pay Later)

- Transaction Value (2023): $316 billion

- Transaction Value (2027): $443 billion

- Share of E-commerce Transactions (2023): 5.1%

- Share of E-commerce Transactions (2027): 5.0%

BNPL services offer flexibility, but their growth rate is stabilizing. As regulations tighten, providers may need to ensure transparent terms and responsible lending practices, especially when considering credit card alternative payment methods.

- Cash on Delivery

- Transaction Value (2023): $124 billion

- Transaction Value (2027): $89 billion

- Share of E-commerce Transactions (2023): 2.0%

- Share of E-commerce Transactions (2027): 1.0%

Cash on delivery remains prevalent in some regions, but its usage is declining. This could be due to the rising popularity of digital payments and concerns about security and returns, prompting consumers to explore online shopping payment methods that offer greater convenience.

- Prepaid Cards

- Transaction Value (2023): $64 billion

- Transaction Value (2027): $73 billion

- Share of E-commerce Transactions (2023): 1.0%

- Share of E-commerce Transactions (2027): 0.8%

Prepaid cards serve niche markets, with modest growth expected. While they cater to the unbanked population, their overall share of e-commerce transactions remains small, emphasizing the need for diverse payment options for ecommerce website visitors.

- Pre-pay

- Transaction Value (2023): $20 billion

Pre-pay options allow upfront payment but lack sufficient data for comprehensive analysis. Further insights are needed to gauge their significance accurately, especially when considering the best payment method for selling online.

- Cryptocurrency

- Transaction Value (2023): $17.5 billion

Cryptocurrency transactions are promising but still niche. With increasing merchant acceptance, their transaction values are set to grow from a small base, offering an innovative ecommerce payment option for those seeking alternatives.

- Post-pay

- Transaction Value (2023): $11 billion

- Share of E-commerce Transactions (2023): 0.3%

Post-pay options have minimal traction, with transaction values and future trends requiring closer monitoring for assessment. As businesses explore payment options for ecommerce website visitors, understanding emerging trends in post-pay methods is essential for catering to diverse consumer preferences in online retail payment options.

The Future of eCommerce Payment Methods

Understanding these trends is vital for businesses to adapt their payment strategies, ensuring they meet consumer preferences and regulatory requirements in the ever-changing e-commerce landscape of 2024.

In conclusion, the array of payment options for online shoppers in 2024 is vast, reflecting shifting consumer preferences and technological advancements.

To thrive in this landscape, businesses must offer diverse options, including e-commerce alternative payment methods like BNPL and A2A transfers.

By staying adaptable and responsive to emerging trends, businesses can optimize customer experiences and drive success in the ever-evolving world of online retail.

Ready to discover more?

- The biggest online marketplaces

- The largest online grocery retailers in the US

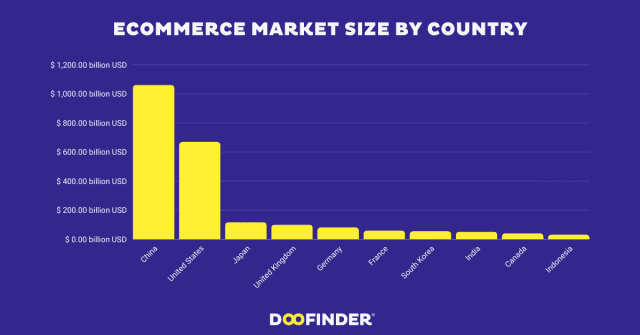

- E-commerce market size by country

Source Acknowledgment: We base our content on reliable sources like Statista, Insider Intelligence, Data Reportal, and Census.gov, renowned for their accuracy, ensuring the credibility of our information.

- Increase your eCommerce sales by 20%

- The 10 largest eCommerce sites in the world

- How to start an online shop from scratch